EU ETS in shipping – what to consider now

November 03, 2022

To incentivise the shipping industry to further reduce emissions and invest in low carbon technologies, the EU wants to include shipping emissions in the so-called EU Emissions Trading System (ETS). In short, the EU ETS sets a price on CO2 emissions. However, it is an open question when exactly the inclusion of shipping comes into force and how the regulations should be implemented. Currently, the European Parliament, European Commission and The Council of the EU are discussing a final framework for the inclusion of shipping under the EU ETS.

In this article, our Advisory Services will update you on facts, pending decisions and recommended considerations.

In general, shipowners, brokers and charterers are currently in a phase of uncertainty. It is difficult to predict in detail how the extension of ETS will affect the shipping industry. But one thing for sure is that decarbonisation is unavoidable in the long run. Sustainability is here to stay, says Jakob Hjortlund, Head of Research at MB Shipbrokers.

How will the ETS affect shipping?

Despite the pending decisions, the EU ETS will undoubtedly affect the financial metrics and liability of operating in EU waters. Besides, the EU ETS will bring about an added administrative burden. To comply with future EU ETS regulations, shipowners must:

- Calculate emissions

- Have calculations verified

- Buy needed allowances

- Submit allowances

- Negotiate with charterers during the year on how to cover the cost.

Due to the costs for allowances and the added administrative burden, the cost of compliance with the EU ETS will likely be significant for owners.

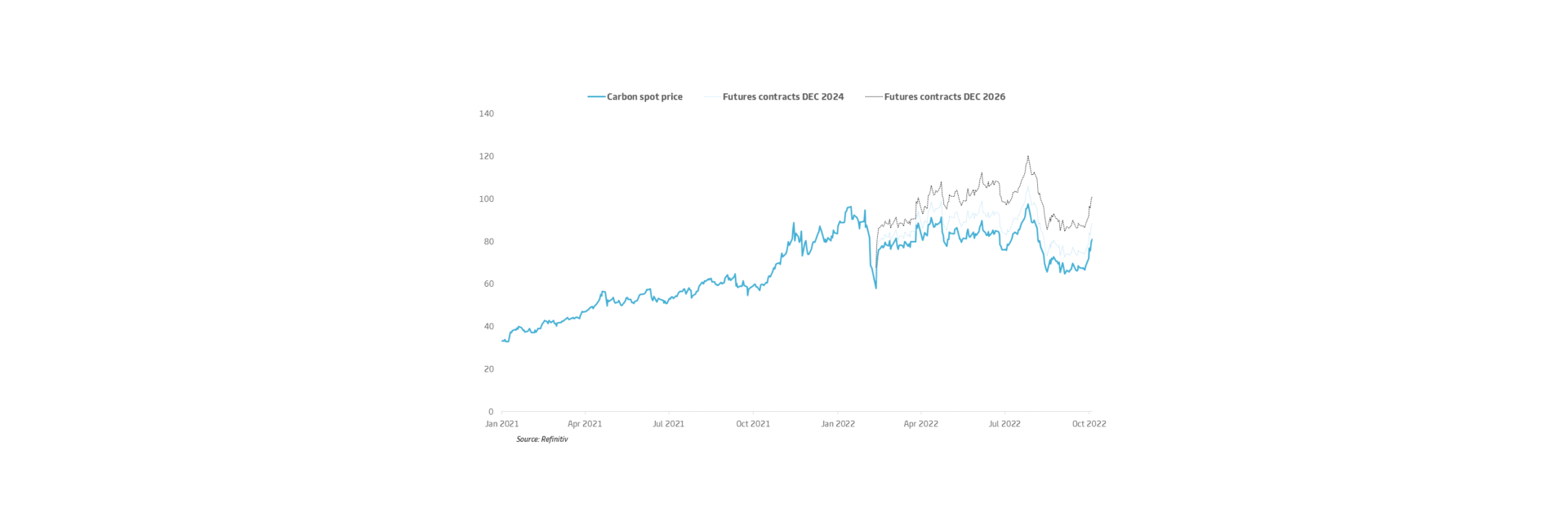

Historic Carbon Price Development:

Historic Carbon Price Development:

To be considered

MB Shipbrokers Advisory Services monitor, discuss and participate in different European forums, and our recommendation is that owners and charterers start preparing for the EU ETS by identifying how they could be affected.

William Norvold Bjørn, Associate in the Energy Transition Team, has conducted extensive research and calculations as to the impact of EU ETS and has the following considerations:

Owners:

- How do I ensure that cost incurred as a result of complying with charterers’ orders can be recovered either via freight or by separate compensation.

- Asset deployment considerations: Are the least energy-effective vessels to be kept away from EU waters?

- Will accelerated decarbonisation of the fleet create commercial value, if so, how?

- Evaluate the compliance across your fleet: The EU ETS evaluates owners as an entity. Thus, failing to meet regulations will put a target on your entire fleet and not the vessel responsible for any exceedance.

Charterers:

- Charterers should consider whether owner or charterer is responsible for acquiring the needed allowances.

- Charter parties are likely to meet less flexibility from owners as they need to comply with regulations, especially for time charter parties.

- Charterers should understand how less flexibility will impact their operations and commercial opportunities.

- Understand benefits and drawbacks of operating within EU waters.

- Is it worthwhile to improve screening process to ensure that they charter the most efficient vessels? Is it worthwhile paying a premium for these?

Both:

- Charterers and owners must monitor voyages in EU waters throughout the year, , as allowances will be accounted for EOY (Dec).

- Charterers and owners must explore standardised clauses that can ease the negotiations.

Jakob Hjortlund reminds that the EU ETS is only one dimension of a general sustainability trend:

- A few years ago, sustainability was solely a question of doing good. Now sustainable solutions, such as having efficient vessels or considering alternative fuels is used as a part of a differentiation strategy. In a few years, decarbonisation will be a commercial imperative in the maritime industry.

- At MB Shipbrokers we stand ready to assist you understand the commercial and technical implications of upcoming regulations. We help our clients in understanding how decarbonisation will affect specific vessels and fleets to develop a strategy to cope with uncertainty, says Jakob Hjortlund.

Background information

- The EU Emissions Trading System (ETS) is a “cap-and-trade” system, setting an absolute limit to the total amount of emissions every year.

- EU ETS was launched in 2005 to fight global warming and is a major pillar of EU energy policy.

- EU ETS regulated entities receive emission allowances they can trade depending on their individual needs. 1 EU allowance (EUA) is equal to 1tCO2

- At the end of each year, all entities must cover their emissions with allowances. Individual surplus can be retained to cover future needs or sold to an entity in short of allowances.

Jakob Hjortlund

Head of Research, Advisory Services

Copenhagen office

+45 3344 1495

jahj@mbshipbrokers.com