Update on EU ETS: Decisions & financial impact

March 22, 2023

Following several years of negotiations, the EU has now finalized the agreement to include shipping in the EU ETS trading system. The final decision was reached on EU level in December 2022 and puts a price on carbon emissions. With this historical agreement, the EU aims at providing incentives to reduce carbon emissions as stakeholders need to surrender emission certificates per tonne of CO2 emitted.

In this article, Advisory Services updates you on the legislation that will come into force in 2024, providing insights into the financial implications for shipowners, operators, and charterers.

What has been decided?

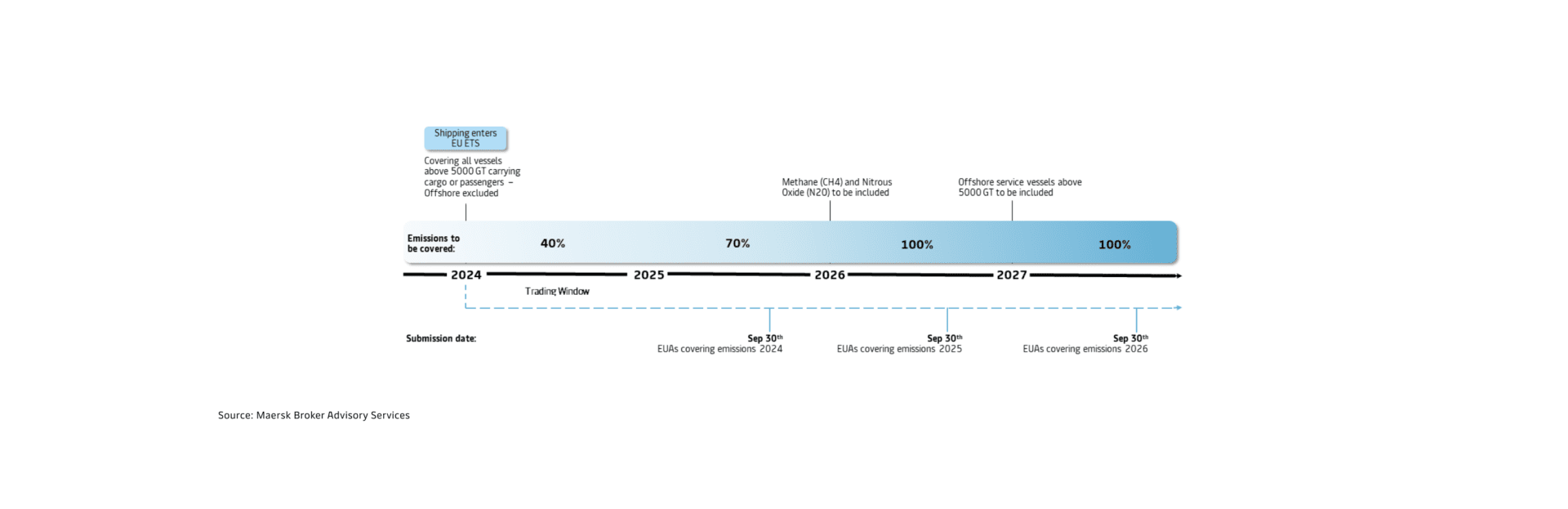

The EU has agreed to gradually include shipping in the EU ETS during a three-year phase in period:

- 2024: 40%* of emissions must be paid in 2025

- 2025: 70%* of emissions must be paid in 2026

- 2026: 100%* of emissions must be paid in 2027

* Based on emissions recorded in the EU Monitoring, Reporting and Verification system (EU MRV)

Starting in 2024, allowances will have to be surrendered latest by September 30th in the following year.

The regulation applies to all freight and passenger vessels above 5,000GT and from 2027, offshore vessels above 5,000GT will also be included. For intra EU voyages, 100% of the emissions must be covered by allowances, and for voyages with a start or an end outside of the EU, 50% of the emissions must be covered. In 2026, the EU ETS will be expanded to include Methane (CH4) and Nitrous Oxide (N2O), consequently impacting the price of burning LNG.

Compliance with the regulation will be measured on a fleet level and failure to surrender emission allowances will lead to the imposition of fines and subsequently refusal of port calls.

Revenue generated from the EU ETS will be reinvested into the sector via an Innovation Fund that supports research and investments needed to decarbonize the maritime industry.

The EU will auction off allowances via the European Energy Exchange (EEX) through a clearing auction. Allowances can be traded over the counter, or buyers can purchase them on the futures market if they aim at mitigating risk. The allowances must be submitted by the DOC holder of the vessel. In the case of a bareboat charter, the charterer holds the responsibility. Shipowners must open an account in the Union Registry via their national registry. Shipowners not registered in the EU are also obliged to open an account.

Annually, the cap on how much CO2 can be emitted, will decrease. For one tonne of CO2, shipowners must submit one EU allowance. With this mechanism, the EU aims at incentivising cost-effective reduction of emissions and aims to speed up the decarbonization of the shipping industry.

What are the financial implications?

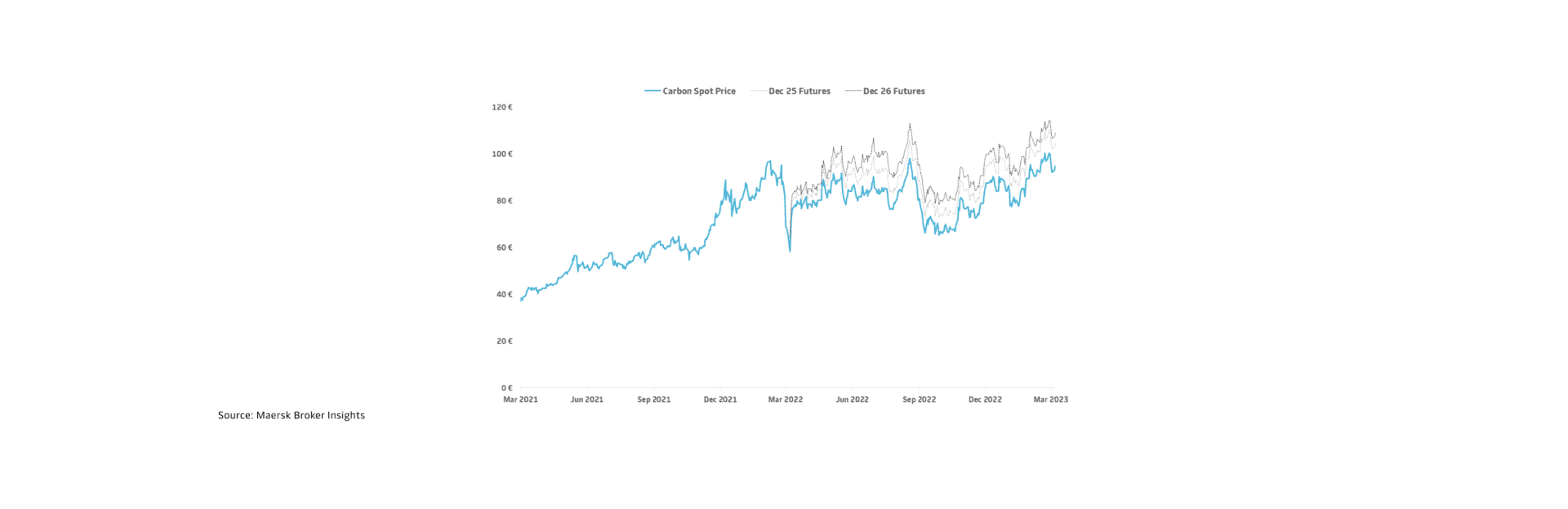

The EU ETS will have significant implications for shipowners and charterers as the operating costs will increase due to the additional costs of the EU ETS. The price of EU emission allowances (EUAs) has been volatile throughout 2022, ranging between €60-100, further contributing to the uncertainty on how significant the financial impact for shipowners will be.

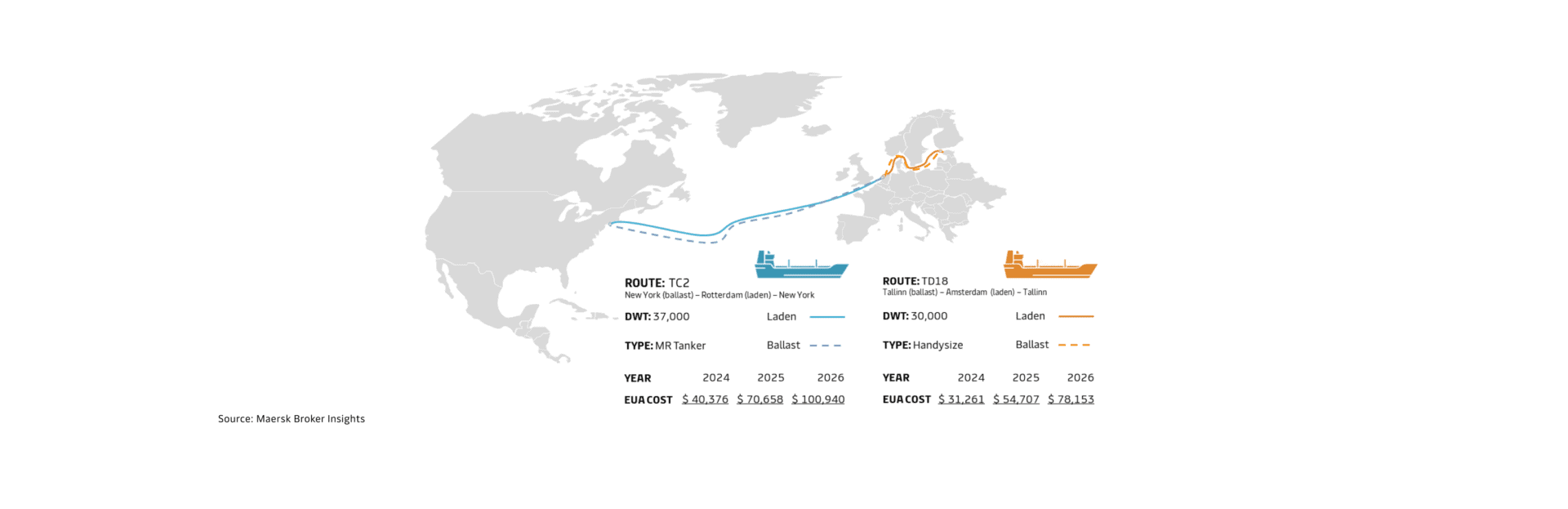

In MB Shipbrokers Advisory Services, we have calculated the expected costs for two Baltic exchange tanker routes (TC2 and TD18) based on today’s spot prices for bunkering and EUAs. Our estimate is based on several underlying assumptions but aims to visualize the additional costs for intercontinental routes and intra-EU routes. By including the cost of EUAs, the total bunker costs increase by as much as 50% in 2026, when the gradual inclusion is complete. Operating only on the TC2 route for a full year will result in carbon taxation above $1.3m given our estimate. Similarly, carbon taxation could surpass $2.3m for a full year on the TD18 route in the years to come.

Owners will need to carefully consider this added cost when calling an EU port next year.

It is yet unclear, which stakeholders will have to bear the increased costs, but shipowners should start considering how to reiterate the costs from the charterer by including the EU ETS in charter parties. Shipowners and operators should also start considering the costs of the allowances and prepare for purchasing and trading the certificates, as it becomes relevant for all business conducted from 1st of January 2024. In addition, questions such as who can buy allowances, and when they should be bought are also important to consider.

Overall, the EU ETS will force the industry to adapt in many aspects. In our Advisory Services, we advise stakeholders in developing a strategy for complying with the EU ETS. Should you be interested in more insights, please reach out to our Energy Transition Team at transition@mbshipbrokers.com or call us directly.

Olof Klintholm

Head of Energy Transition

Copenhagen office

+45 3123 8683

okl@mbshipbrokers.com